AUTOMATING REVIEW MANAGEMENT WITH AI

How Standard Bank automated responding to 80% of all reviews

to ensure immaculate service delivered faster than ever before — with excellent results.

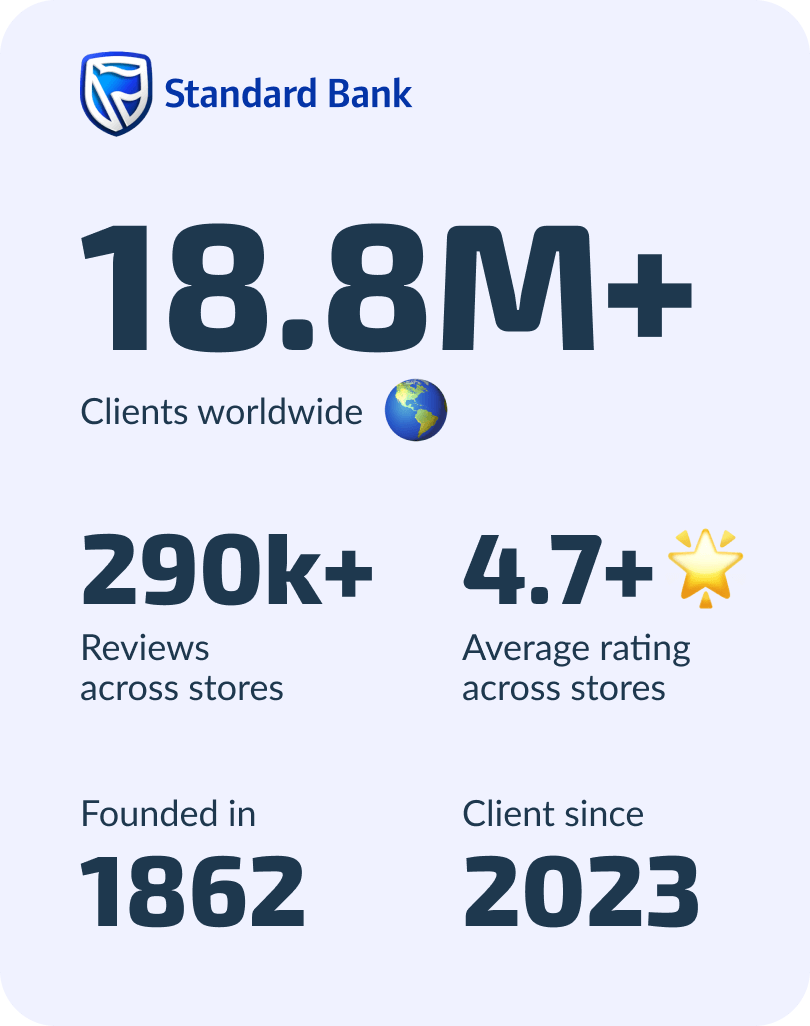

Standard Bank, a well-established bank in South Africa, keeps up with new technology to stay competitive. With customers around the world, the bank uses AI to make its customer service fast.

Key satisfaction

Using AI to answer common questions quickly has greatly improved response times at Standard Bank. This lets staff handle more complex issues and enhance the quality of service to incredible levels.

Numbers reached with AppFollow

80%

of reviews are responded to with AI

90%

reviews auto-tagged

646%

more thumbs-up ratings from customers

50%

CSAT rating, with an industry average of 15%

Challenges

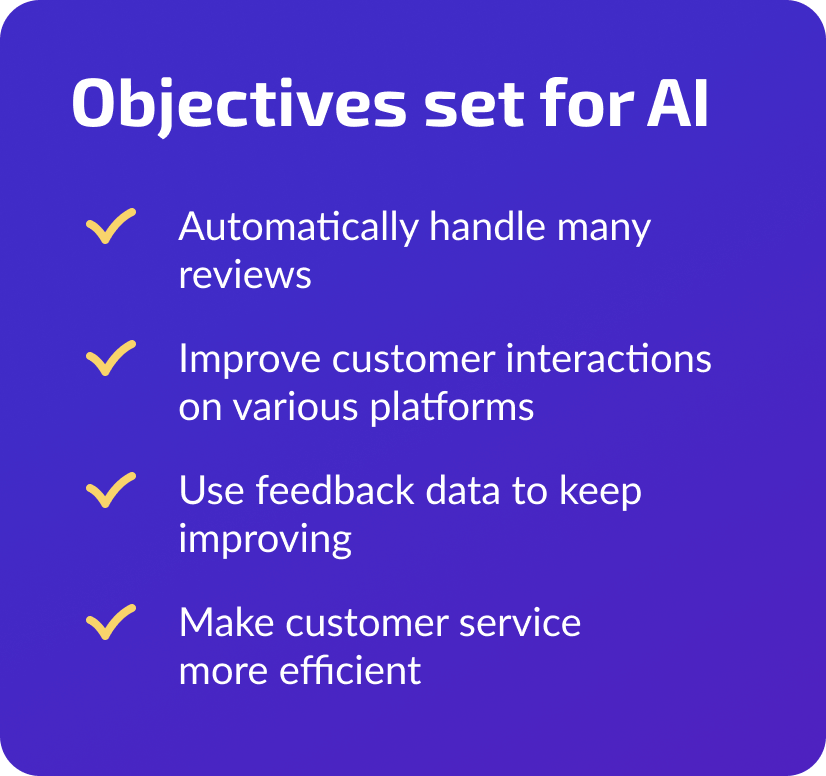

Apart from support tasks, one of the challenges is responding to all reviews. On the Android app, Standard Bank gets 800 mentions on average per month. Agents go through each message, respond, investigate, and perform mundane tasks, taking a lot of time. Before the introduction of automation and AI, everything was done manually, which isn’t really scalable and leaves users waiting for a response.

The KPIs that Standard Bank tracks with AppFollow

“We always check if our solutions are working for the clients. We measure the true customer satisfaction score when customers return and re-rate or update their reviews.

We also aim to reach most customers within the required timeframe. Previously, it could take hours, and if the moderator left at five o'clock, there was no response. Now, with AI, we have continuous engagement.”

Pain points & use case

- Mixing automated and personal service

- Keeping AI responses accurate with ongoing training

- Dealing with complex customer issues that need human help

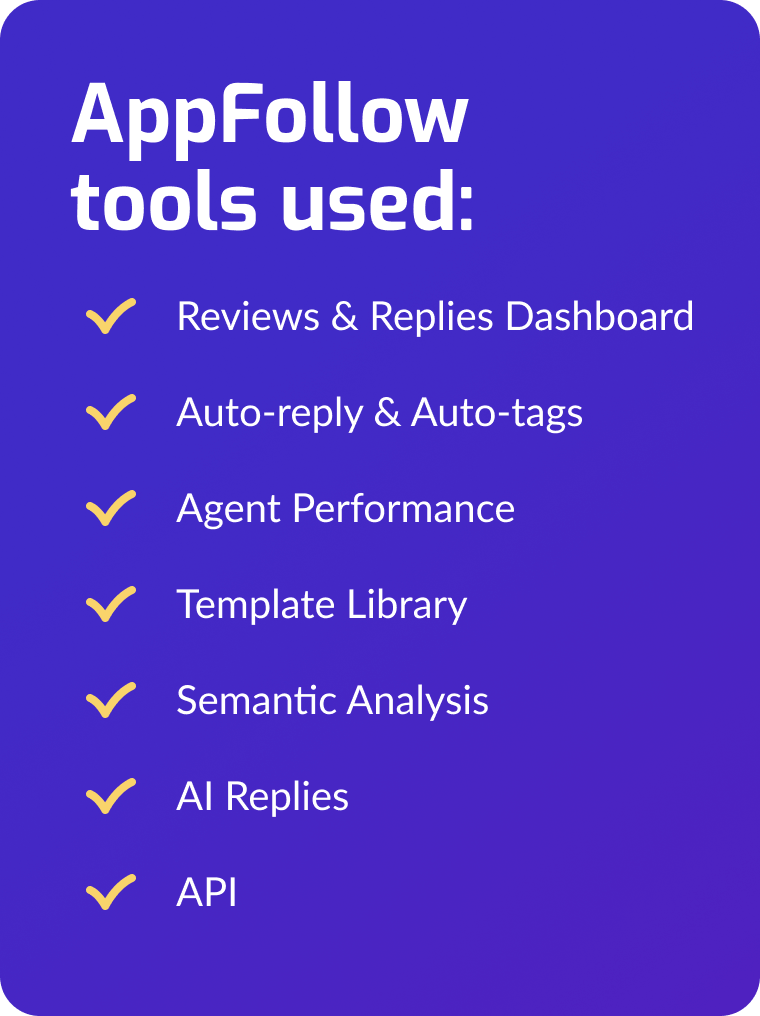

Other AppFollow features in use

Reporting tools help with real-time updates to check lifetime score, average score for the time period, star rating dynamics, and agent performance.

AppFollow’s AI-powered review management changed the game

80% of Standard Bank’s reviews are auto-responded to. This means that within seconds, customers can get a response with which they can self-service. 20% of those cases that could not self-service are able to be contacted by an agent who assists them. After the usage of automation, we saw a 646% growth in positive engagement.

"Using automation helps us reply faster to customers and still give personal help with tough issues. We are committed to improving our AI to offer the best service in banking."